The first institutional family office focused exclusively on high risk assets.

Since 2023, Third State has invested in digital assets and blockchain companies, as well as other traditional forms of securities providing the firm with the full spectrum of exposure to the space.

A PASSION FOR THE CHAOS!

As a family office, we only trade with our own capital; which gives us access to a wide range of high risk assets that traditional fund managers deem risky to trade.

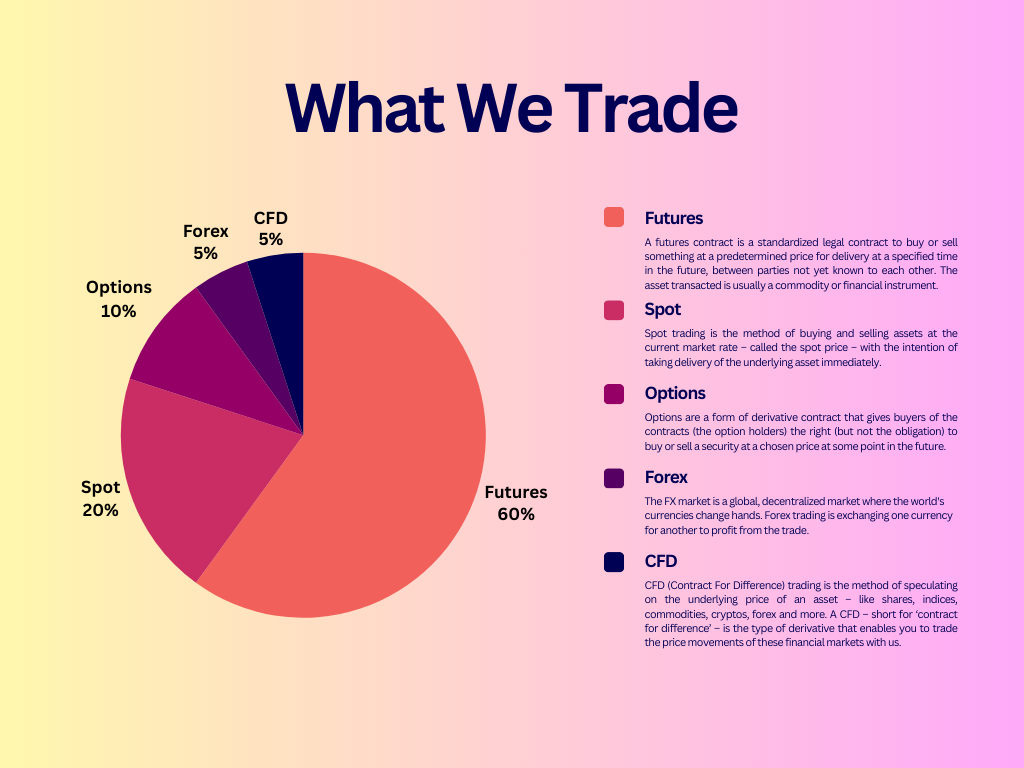

Our comprehensive trading strategy caters to a diverse list of assets, ranging from stocks to cryptocurrency to CFDs. Our strategy thrives on chaos and volatility. If there is liquidity to be grabbed, liquidity will be grabbed!

EVENT-DRIVEN APPROACH

Third State seeks to invest in situations where identifiable catalysts exist which can unlock value and close the gap between market value and intrinsic value. We strive to find idiosyncratic opportunities, including those less-trafficked or exhibiting asymmetric returns. Potential sources of event opportunities include corporate transactions and complex market, regulatory, or legal events. Our investment process is characterized by rigorous “bottom-up” fundamental research and analysis.

CROSS-ASSET CLASS CAPABILITIES

Third State’s investment team has expertise in a variety of special situation strategies across asset classes, including equity, credit, and convertible securities. A flexible investing approach allows us to express an investment thesis through securities offering the best risk-reward in our assessment.

BETA-NEUTRAL PORTFOLIO

We maintain a low beta mandate, as we believe situation-specific risk is better for us than directional risk.

MODERATELY CONCENTRATED PORTFOLIO

We focus risk through a moderately concentrated single portfolio with capital concentrated in our highest conviction ideas.

RISK MANAGEMENT

Risk management is an integral part of the investment process. The risk management process is intended to balance a “bottom-up” approach to security selection with portfolio level risk filters, and guidelines, and a variety of credit, equity, and volatility hedging strategies are utilized in an effort to reduce market exposure.

A STEWARD OF CAPITAL

The investors in our strategy are just us. Our investment philosophy strives to preserve the capital that we rely on for the future, while growing our assets to meet our targets.

AN ARRAY OF RESOURCES

ur comprehensive suite of professional services caters to a diverse clientele, ranging from homeowners to commercial developers.

A history of taking risks and coming out strong!

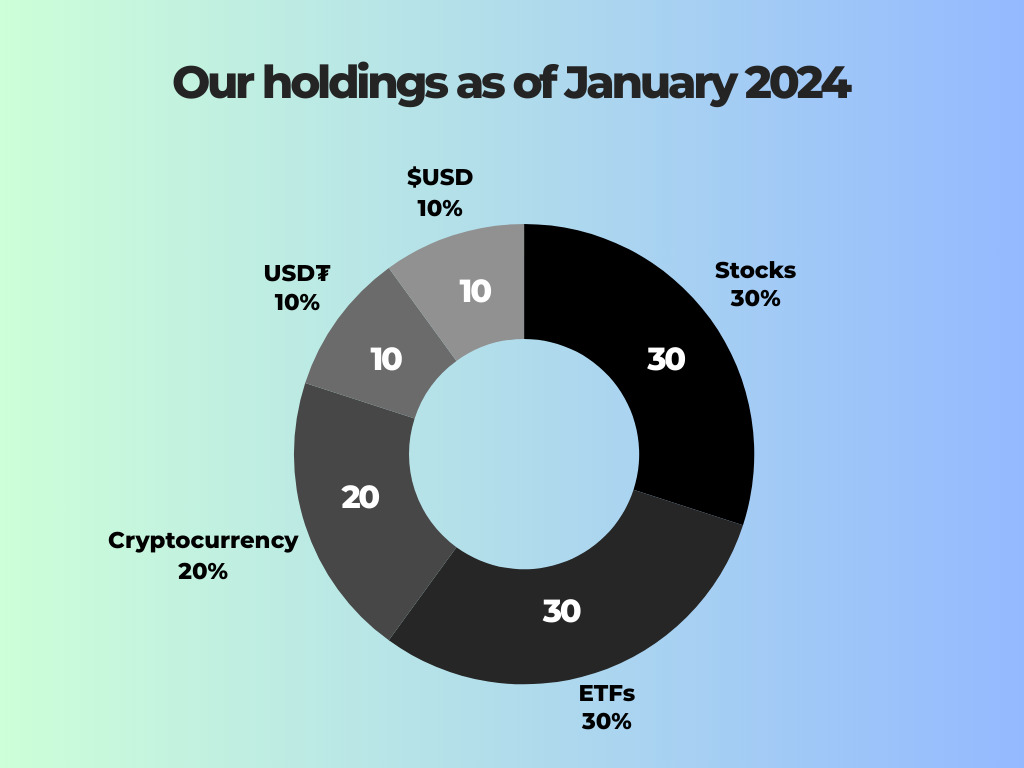

- The vast majority of our trading profits comes from trading spot holdings.

- We mitigate the risks by holding 40% of our total investments as stocks, ETFs and various cryptocurrencies.

- In an ever evolving world of finance, we are always trying to keep up with the market and diversify our investments in multiple forms of securities.

Diversification of Assets

- 30% of our total investment portfolio consists of individual company stocks, 30% ETFs and 20% as cryptocurrencies.

- We hold 10% of our investment portfolio in the form of USD.

- The remaining 10% of the investment portfolio is always secured as USDT.

“It’s not about having lots of money. It’s knowing how to manage it“

dave

Emperor, The Third State

Watch, Read, Listen

Join 900+ subscribers

Stay in the loop with everything you need to know.